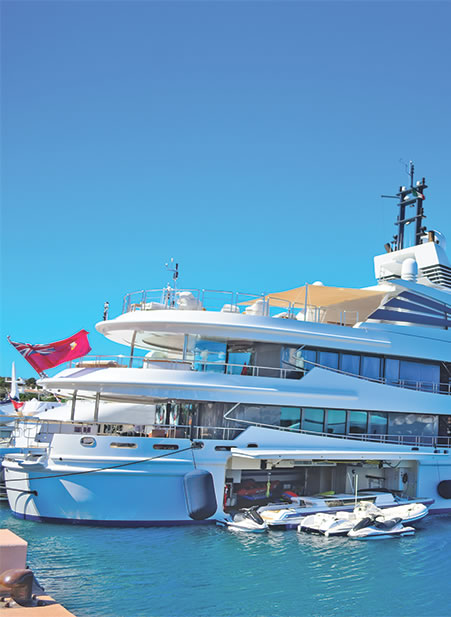

Marine Trade

COVER YOU WON’T WANT TO TRADE

At Insure-A-Boat, our specialist marine trade team is dedicated to providing excellent customer service and many are experienced sailors, members of sailing and rowing clubs and hold RYA qualifications. We therefore bring with us a depth of understanding of the insurance needs of a variety of marine trade sectors including boat builders, boatyards, boat repairers, sailing schools, marine cargo businesses, marine operators, shipwrights, yacht agents, offshore workers and more.

A typical marine insurance or boatyard insurance policy can include cover for:

- Business property at and away from your premises

- Goods in transit & business interruption

- Exhibition cover

- Boat builders risks

- Employers’ liability, products liability and public liability

Get a Quote